stages of life - starting out

You just started your career, you work hard, you play hard, and have lots of time to worry about retirement savings. No reason to be worried about benefits offered at your PUD - right? Not exactly. Here are a few questions you may want to ask.

What happens if I get injured? How much do I have to pay for medical bills?

How can I use my HRA VEBA dollars? Can I use them now? What happens to my savings if I leave the PUD?

I’m enrolled in PERS. Why should I contribute to a deferred compensation account if I have a pension through PERS? What happens if I leave the PUD and public employment?

Are there other benefits I don’t know about?

medical coverage

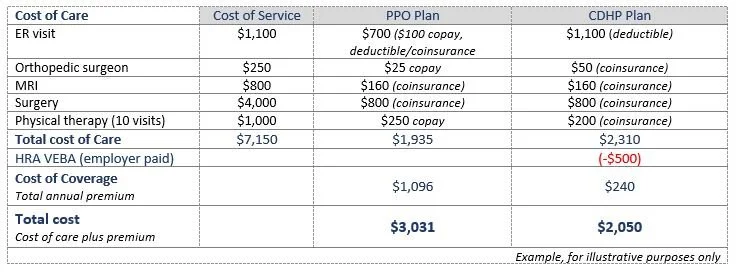

During benefits open enrollment you can decide which medical plans you are enrolled in. There are two plans to choose from. Both plans cover the same services. The difference is in how you pay for coverage.

PPO Plan - pay and forget about it

You pay $91.35 per month ($1,096 per year) in premiums, even if you don’t see a doctor. When you do, you pay a $25 copay for most services. For complex care, you will have to pay your $500 deductible, then 20% coinsurance until you meet your $2,000 out of pocket maximum.

CDHP Plan - pay as you go

You pay $20 per month ($240 per year) in premiums. If you see a doctor you will have to pay your $1,100 deductible first, then 20% coinsurance until you meet your $3,200 out of pocket maximum. Preventive care is covered in full. To help offset some of these cost, you get a $500 HRA VEBA contribution.

Let’s compare your cost if you get injured:

resources:

Download the Cost Comparison Tool and estimate your cost. Model the best and worst case scenario, and your typical plan usage.

Need a primary care provider? You, as a Premera member, can use Kinwell, primary care clinics located in Pasco, East Wenatchee and Spokane. Or schedule your virtual visit if none of the clinics are near you.

Need help navigating the health care system and deciphering your medical bills? Your personal Health Advocate can provide hands-on, confidential support to make sure that you get the right care at the right time, at no cost to you.

HRA VEBA

Your PUD pays into your HRA VEBA account to help you pay expenses not covered by insurance and to save for medical premiums when you retire. You decide if you want to use your money now, or later. The money is yours - even if you leave the PUD. The account is in your name and you can reimburse yourself for eligible out-of-pocket expenses even after you leave the PUD.

investment options:

When you first were hired you made a lot of decisions. Now is the time to take a look at how your HRA VEBA dollars are invested to make sure you meet your needs.

Do you want to use your HRA VEBA dollars now? Then preserving your money by choosing a conservative option may be right for you.

Do you want to save your HRA VEBA dollars? Then a long-term investment strategy may be right for you.

Visit https://www.hraveba.org/ to review and make changes to your investments at any time.

SAVING WITH FLEXIBLE SPENDING ACCOUNT

Are you looking to get lasik eye surgery or orthodontia this year? If yes, signing up for a health care flexible spending account might be interesting to you. When enrolling, you determine how much money you want to set aside through payroll deduction in 2024. The entire amount will be available to you for reimbursement on day one. Basically, you give yourself an interest free loan towards health care expenses.

Plan carefully how much money you set aside as you will lose unspent dollars.

DEFERRED COMPENSATION

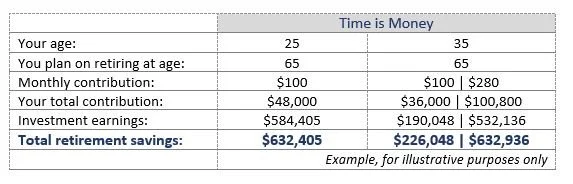

You are enrolled in the Public Employee Retirement System (PERS) which provides you a guaranteed monthly retirement benefit. So why should you set aside more money for retirement?

Do you want to buy a nice ride to celebrate retirement? Do you want to travel and buy a motor home to enjoy retirement? Do you want to golf every day? If you answered YES to any of the questions or want a large amount of “play money” when you retire, you want to start saving now! Investing early makes a difference! That’s because of compound interest.

You are saving already? Perfect! Crunch the numbers and find out how much more you could earn if you saved $20, $40, $100 per month more. And don’t forget to review your investment options occasionally to make sure you are on track.

What happens to your money when you leave the PUD before you retire? Your contributions and the contributions made to your account by your PUD are yours to keep, even if you leave your PUD.

LIFE INSURANCE

Do you have loved ones that depend on you? If so, it’s important to review your life insurance coverage:

Your PUD buys one time your annual earnings (base wages) in life insurance and the same amount in accidental death and dismemberment (AD&D) insurance. If you die of natural causes, the life insurance policy will be paid to your beneficiary; if you die because of an accident, both life and AD&D insurance will be paid out.

LIfe insurance premiums are inexpensive when you are young and go up with age.

Buy additional life insurance during open enrollment with no medical questions asked (up to $200,0000), or increase your coverage to $220,000 if you already purchase $200,000, without proof of good health. The maximum you can buy is $500,000 or five times your annual base earnings with proof of good health.

AD&D insurance protects your loved ones in the event you die of an accident and is inexpensive. You can buy up to $500,000 or five times your annual base earnings in coverage, with no medical questions asked.

Crunch the numbers! Download Life Insurance Calculator and find out how insurance you can buy while staying in your budget.

other benefits

life coaching:

In addition to free counseling, your Employee Assistance Program (EAP) provider ACI can help you define personal and professional goals and plan a strategy for achieving them. Learn more here.

travel assistance:

You took off skiing at Whistler, British Columbia and lose your passport. What now? Contact free travel assistance services to get you squared away. Learn more here.