stages of life - starting a family

You found the love of your life and maybe you are thinking about expanding your family by two more feet. There is lots to consider when providing for a growing family. Here are a few questions you may want to ask.

We are having a baby. How much do I have to pay for medical bills?

Medical and childcare expenses are adding up. Can I save for medical and childcare expenses through a payroll deduction? Can I use my HRA VEBA dollars for medical expenses?

How do I balance providing for my family and saving for retirement? Will my PERS pension be enough? How can I save extra money but not be locked in?

How do I make sure my family is ok if I die? Is there life insurance available through my PUD?

Are there other benefits I don’t know about?

medical coverage

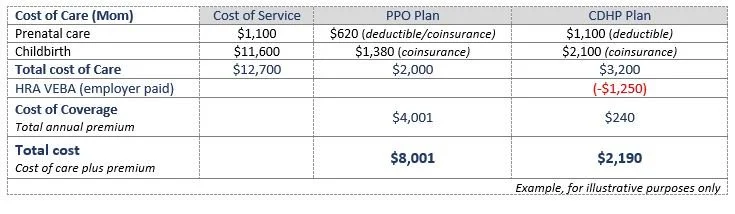

During benefits open enrollment you can decide which medical plans you are enrolled in. There are two plans to choose from. Both plans cover the same services. The difference is in how you pay for coverage.

PPO Plan - pay and forget about it

For a family, you pay $333.41 per month ($4,001 per year) in premiums, In addition you pay a $25 copay for most services. For complex care and hospitalization, you will have to pay a $500 individual or $1,500 family deductible, then 20% coinsurance until you meet your $2,000 individual or $6,000 family out of pocket maximum.

CDHP Plan - pay as you go

You pay $20 per month ($240 per year) in premiums regardless how many family members you cover. If you see a doctor you will have to pay your $1,100 individual or $2,200 deductible first, then 20% coinsurance until you meet your $3,200 individual or $6,400 family out of pocket maximum. Preventive care is covered in full. To help offset some of these cost, you get a $1,000 HRA VEBA contribution for you and your spouse and $250 for your child(ren).

Let’s compare your cost if you are having a baby:

resources:

Download the Cost Comparison Tool and estimate your cost. Model the best and worst case scenario, and your typical plan usage.

Need a primary care provider? You and your covered dependents, as a Premera member, can use Kinwell, primary care clinics located in Pasco, East Wenatchee and Spokane. Or schedule your virtual visit if none of the clinics are near you.

Need help navigating the health care system, get a second opinion, or sort through your medical bills? Your personal Health Advocate can provide hands-on, confidential support to make sure that you get the right care at the right time, at no cost to you.

saving for medical and child care expenses

During open enrollment, you can elect to set aside money for expected out-of-pocket healthcare and/or dependent care expenses by enrolling in Flexible Spending Accounts (FSA). Contributions to your FSA account are deducted from your paycheck each month, reducing your taxable earnings. Plan carefully how much money you set aside as you will lose unspent dollars.

Dependent Care FSA: Save up to $5,000 for eligible dependent care expenses, such as childcare, nursery school, pre-school, before/after school care etc.

Health Care FSA: Save up to $3,050 (in 2023) for eligible health care expenses, such as copays, deductibles, orthodontia, prescription glasses, etc.

HRA VEBA

Your PUD pays into your HRA VEBA account to help you pay expenses not covered by insurance and to save for medical premiums when you retire. As your family grows, you may want to review your investments to make sure how you invest your money is in line with how you plan on using your HRA VEBA dollars:

Do you have growing medical bills and want to use your HRA VEBA dollars now? Then preserving your money by choosing a conservative option may be right for you.

Are you planning on saving your HRA VEBA dollars until you retire? Then a long-term investment strategy may be right for you.

Here is a guide on choosing your investment allocations. Visit https://www.hraveba.org/ to review and make changes to your investments at any time.

retirement savings

With so many demands coming at you, it’s sometimes difficult to prioritize current spending and saving for your retirement. The good news is that you are enrolled in the Public Employee Retirement System (PERS) which provides you a guaranteed monthly retirement benefit. How much you receive when you retire depends on the plan you are enrolled in, how long you work, your age at retirement, and if you provide a loved one with a survivor benefit. Visit https://www.drs.wa.gov/ to estimate your pension by selecting the “Benefit Estimator” in your online account. And while you are there, review your beneficiary information by clicking on “My Account.”

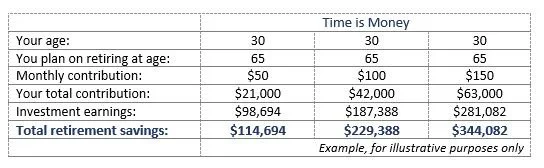

In addition, you may want to consider to contribute to a 457 account. You can enroll and increase/decrease your contributions at any time. Remember, time is money, and even small monthly contributions can add up over time.

You are saving already? Perfect! Crunch the numbers and find out how much more you could earn if you saved $20, $40, $100 per month more. And don’t forget to review your investment options occasionally to make sure you are on track.

life insurance

As your family grows, more lives depend on you. That’s why it’s important to review your life insurance coverage:

Your PUD buys one time your annual earnings (base wages) in life insurance and the same amount in accidental death and dismemberment (AD&D) insurance. If you die of natural causes, the life insurance policy will be paid to your beneficiary; if you die because of an accident, both life and AD&D insurance will be paid out.

Buy additional life insurance during open enrollment with no medical questions asked (up to $200,0000), or increase your coverage to $220,000 if you already purchase $200,000, without proof of good health. The maximum you can buy is $500,000 or five times your annual base earnings with proof of good health. Premiums go up as you age, so it’s important you review your coverages occasionally.

AD&D insurance protects your family in the event you die of an accident and is inexpensive. You can buy up to $500,000 or five times your annual base earnings in coverage, with no medical questions asked.

Crunch the numbers! Download Life Insurance Calculator and find out how insurance you can buy while staying in your budget.

other benefits

help with anything on your to-do list:

In addition to free counseling, your Employee Assistance Program (EAP) provider ACI can help you with almost anything on your to-do-list. From unlimited child care referrals, to legal and financial consultations, ACI is here for you. Learn more here.

travel assistance:

You are taking your family on a road trip and forgot your child’s asthma medication at home. What do you do? Contact free travel assistance services to get you squared away. Learn more here