grant PUD

retirement

so you can start a new chapter - on your terms

You have access to two different benefits plans:

a defined benefit plan (pension) through the Department of Retirement Systems and

a defined contribution plan (similar to a 401k), administered through Mission Square Retirement.

The choice is not one or the other - but both, if you choose to enroll.

Defined benefit plan

public employee retirement systems - PERS

What is a defined benefit plan (pension)?

Provides you with a guaranteed lifetime retirement benefit.

Offers a pension that is based on your average final compensation (highest five consecutive year earnings) and years of service.

Provides a right to pension benefits (vesting).

Includes disability and death benefits.

enrollment

who can enroll?

You - if you are a regular and active employee. On-call or temporary employees may be eligible. Check with HR to find out more.

do i have to enroll?

Yes. If you are eligible you have to enroll in one of the three PERS plans. You have 90 days from when you become first eligible to pick a plan. If you can’t decide, you will default into PERS Plan 2.

pers plans

There are three PERS plans, but PERS Plan 1 is limited to those who have established membership with PERS before October 1, 1977.

Most of us have the option between PERS Plan 2 and PERS Plan 3.

How are my pension benefits calculated?

PERS Plan 2:

2% x service credit years x average final compensation = monthly pension benefit

PERS Plan 3:

1% x service credit years x average final compensation = monthly pension benefit. In addition, you will have access to your defined contribution account, which is based on your contributions and investment performance.

sign me up!

Visit your home page and navigate to “Forms” to get enrolled.

more information

The DRS website is packed full of great information, including recorded webinars, videos, calculators. Visit the DRS website, regardless if you are new to PERS, if you have been at it for a while, or if you have almost reached the finish line.

ready for retirement?

Check out the Retirement Planning Checklist and visit DRS Retirement Resources to plan for your upcoming retirement.

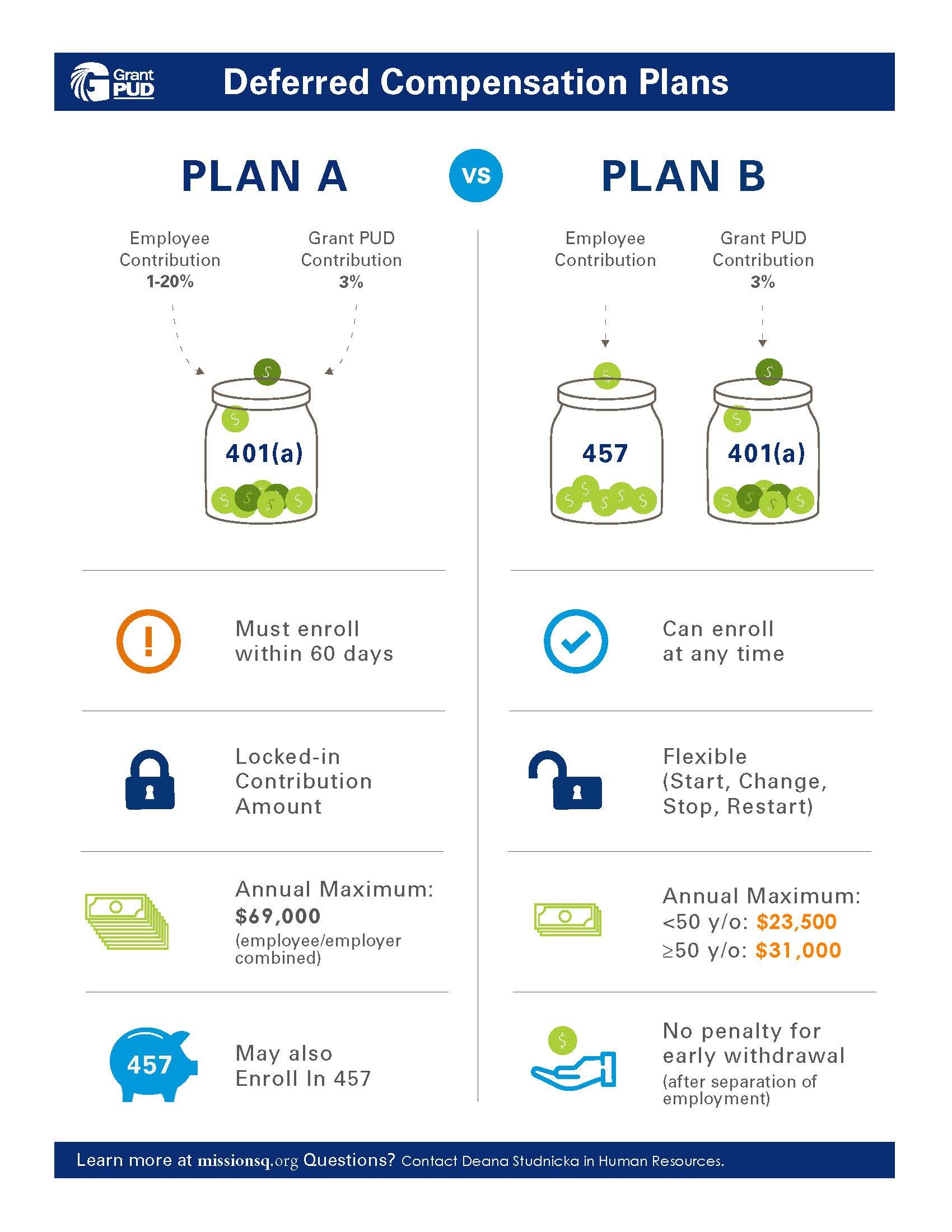

defined contribution plan

401(A) AND 457(B) PLANS

WHAT IS DEFINED CONTRIBUTION PLAN?

Provides you with income at retirement. There is no guaranteed lifetime benefit.

Both you and the PUD can contribute. Your contributions are pre-tax, unless you contribute to a Roth IRA.

You make investment decisions, which may include pre-packaged investment options.

Your retirement income depends on how much money was contributed and investment returns.

ENROLLMENT

WHO CAN ENROLL?

You - if you are a regular, full-time and part-time employee. Temporary employees can contribute to the 457 plan.

DO I HAVE TO ENROLL?

Yes. The PUD contributes 3% of your regular, straight-time pay to your 401(a) Money Purchase Savings Plan, regardless of your irrevocable 60 day election choice. All regular, full-time and part-time employees have to establish a 401(a) plan to receive a 3% contribution from the PUD. Part-time employees will receive this benefit based on a 20-hour work week.

You don’t have to contribute your own dollars to a deferred compensation account to earn the PUD’s contribution.

Temporary employees are not eligible to receive the PUD’s contribution.

Key Plan Features

More information

CONTACT INFO:

mission square retirement

800.669.7400

missionsq.org

Or contact your Retirement Plan Specialist

Matt Barton

Phone: 202.759.7116

Email: mpbarton@missionsq.org