charting your course

medical

Two paths leading to the same great medical coverage.

You decide which path you take during benefits open enrollment.

The journey starts here!

During benefits open enrollment you can decide which medical plan you enroll in. There are two plans to choose from, the PPO and CDHP plan. Both plans cover the same services (e.g., unlimited chiropractic care, preventive care covered in full, etc.). But, there are differences in out-of-pocket costs (how much you have to pay when you get medical care).

first: learn the terms

Co-pays: A fixed amount you pay for covered health care services and prescription drugs.

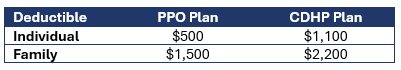

Deductible: The total amount you pay in each calendar year before the plan starts to make payments for certain covered healthcare costs. You pay down the deductible with each claim. Some services are not subject to the deductible.

Co-insurance: The percent of cost (20% for in-network services) you pay for certain covered services. Some services are not subject to co-insurance.

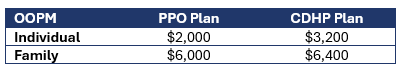

Out-of-pocket maximum (OOPM): This is the most you pay each calendar year, including copays, deductibles and co-insurance.

second: COMPARE THE PLANS

CDHP Plan: Except for preventive care, you have to pay the deductible first, then 20% coinsurance up to your maximum out-of-pocket amount. This also applies to prescription drugs.

PPO Plan: You pay a $25 copay for most services. You have to pay the deductible and 20% coinsurance for complex care. Prescription drugs will cost $10 - $50 per month, depending on the medication you take.

THIRD: Crunch Numbers

Premiums are very different depending on which medical plan you enroll in. You decide if you prefer paying a higher premium for lower out-of-pocket costs or paying a lower premium for higher out-of-pocket costs. Your PUD will make a contribution to your HRA VEBA account when enrolling in the CDHP plan.

PPO Plan: You pay 12% of the total premium. Because you have to pay less out-of-pocket when you get care, the premiums are higher than the CDHP plan.

CDHP Plan: You pay $20 per month. Because you have higher out-of-pocket costs when get care, your monthly premiums are lower than the PPO plan.

Employee only: $500; Employee & Spouse: $1,000; Employee & Child(ren): $750; Employee and Family: $1,250.

fourth - arriving at the best decision for you

You compared out-of-pocket costs and premiums but are still unsure? Here are a few questions you may want to ask yourself:

Is my budget flexible enough to cover unexpected healthcare expenses?

Would I rather be paying higher premiums, deducted from my paycheck pre-tax, and pay a fixed copay for doctor visits and prescription drugs?

Am I prepared to pay the deductible before the insurance kicks in? Even after the deductible is met, can I continue to pay 20% of the cost of care until my out-of-pocket maximum is met?