charting your course

LONG-TERM DISABILITY

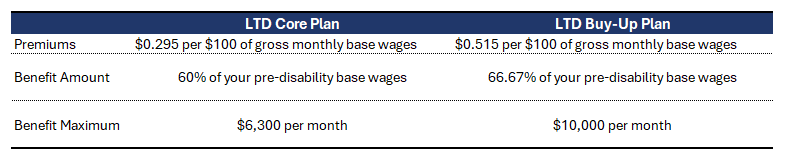

Two plans providing a monthly income if you become disabled and can no longer work.

You decide if the Core Plan or Buy-up Plan is right for you.

The journey starts here!

During benefits open enrollment you can enroll in either the long-term disability core or buy-up plan.

first: learn the terms

Premiums: Premiums are paid by you in full and are based on your straight-time wages. The premium is deducted after tax from your paycheck, which makes the long-term disability benefit payment tax free.

Waiting Period: You must be unable to work for 180 consecutive days before being eligible for the benefit. You may receive a short-term disability benefit during the waiting period.

Long-term Disability Benefit Amount: If you are approved for the long-term disability benefit, you receive a tax free monthly benefit payment. The benefit is calculated as a percent of your pre-disability straight time earnings.

Maximum Benefit and Duration: Your monthly disability benefit it capped at a maximum benefit payment. Typically, benefits will not exceed your Social Security Normal Retirement Age.

second: COMPARE THE PLANS

THIRD: Crunch Numbers

You pay a higher premium for a benefit that you may or may not receive. Download the long-term disability calculator to estimate your monthly premium and monthly benefit amount.

fourth - arriving at the best decision for you

You compared premiums and estimated your potential long-term disability benefit but are still unsure? Here are a few questions you may want to ask yourself:

How likely is it that I become totally disabled while working at the PUD?

Is the higher monthly premium worth the higher income potential in the event I become totally disabled?